THE APPRENTICESHIP LEVY

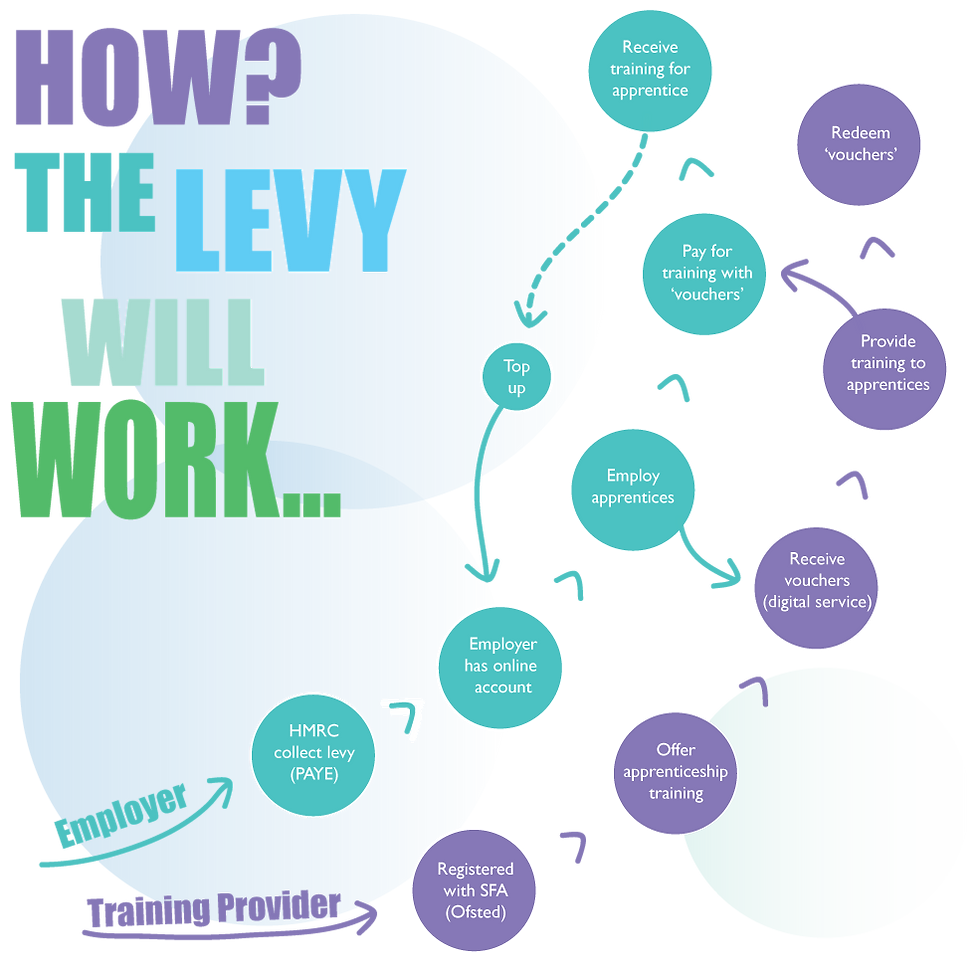

Below are the new changes to the way apprenticeship funding works:

-

the government has introduced a new apprenticeship levy

-

and also an apprenticeship service - this is an online service that allows employers to choose and pay for apprenticeship training more easily

-

in addition there is also a new ‘co-investment’ rate to support employers who don’t pay the levy (‘co-investment’ is when employers and government share the cost of training and assessing apprentices)

If you’re an employer with a pay bill over £3 million each year, you must pay the apprenticeship levy from 6 April 2017.

The levy will not affect the way you fund training for apprentices who started an apprenticeship programme before 1 May 2017.

To find out more information on how the Apprenticeship funding will work click here.

IS MY BUSINESS AFFECTED?

If your annual pay bill is £3 million or more, then you will be paying the Levy. You will also receive an allowance of £15,000 per annum to offset against your Levy payments.

If you pay the Levy and employ apprentices you can receive government top-up funds. You will then be able to use digital vouchers to spend your funds on apprenticeship programmes from John Ruskin College.

If your annual pay bill is below £3 million you will not be required to pay the Levy, but you can still employ apprentices via an alternative, co-investment scheme.

It is expected that over 98% of businesses will not be required to pay the Levy, but will be able to benefit from the funds raised.

See the examples below of how the Levy works and follow the links below for full details of the Levy and proposed changes to Apprenticeships.

So, which one are you?

click below for more information

HOW TO SET UP AN ACCOUNT

To use the Apprenticeship service you will need to register your organisation, once you create your account you can:

-

receive levy funds for you to spend on apprenticeships

-

manage your apprentices

-

pay your training provider

-

stop or pause payments to your training provider

But before you start, ensure you have the following information:

Your levy funds are based on the levy amounts you declare to HMRC through your PAYE schemes. To access your funds you will need:

-

the Government Gateway login details for your PAYE schemes (ask your payroll department if you don't have access to this)

-

your organisation's Companies House number or Charity number (only if your organisation has one)

If you cannot find your Government Gateway login please click here

If you need to search or confirm you Companies House Number please click here

Once you have all your information ready click here to Get set up as a user!